Life’s Good When It’s Insured!

I’m a Financial Advisor serving all across New Zealand. I, Anu, at Kiwiana Financial Services Limited bring decades of insurance, business and life experience, to help you choose the best options available to insure & secure your loved ones and insure you 100%.

Less Worries

Stay Happy

Protected Family

Future Protected

Hi, I’m Anu

Born and raised on the beautiful Vanua Levu island in Fiji, I’ve always had a deep appreciation for the importance of family and security. When I moved to New Zealand 11 years ago, I noticed a significant lack of understanding about insurance. That’s why I decided to start my own company, Kiwiana Financial Services.

With 7 years of experience in the insurance industry, I’m passionate about helping New Zealanders protect their loved ones and assets. Kiwiana Financial Services Limited specialize in life, business & health insurance and KiwiSaver and offer personalized, reliable support to ensure your future is secure.

Kiwiana Financial Services Limited provide financial advice about products from certain providers:

- For life insurance, we work with four companies – AIA, Asteron, Fidelity Life, Partners Life.

- For health insurance, we work with three providers – AIA, Partners Life & NIB.

- For KiwiSaver, we work with a provider – Generate.

7

Years of Experience

100+

Clients Served

5

Industry Partners

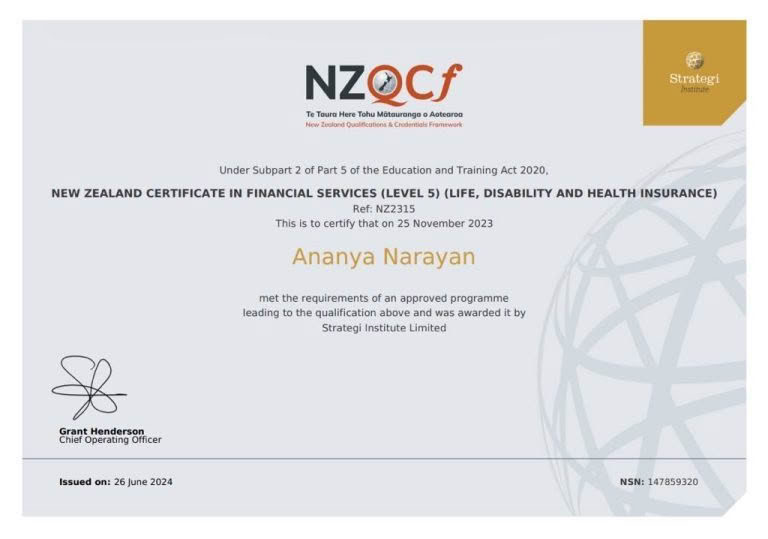

New Zealand Certificate in Financial Services (Level-5)

Featured Services

Kiwiana Financial Services Limited offer multiple insurance services to insure and secure you, your family and your business.

Medical Insurance

Choosing a reliable medical insurance can help you reduce stress and offer a relaxed treatment journey.

Life Insurance

Life Insurance is the best way to give financial backup to your loved ones if something unfortunate happens to you.

Business Insurance

Build your business in good times and protect it in bad times with Share Holder Protection, Debt protection and Loss of Revenue.

What We Offer

✔ Personalized Services: Deliver tailored financial solutions, including personalized investment plans, retirement strategies, and financial advice to meet specific client needs and goals.

✔ Exceptional Customer Service: Building a reputation for outstanding customer service by being responsive, empathetic, and proactive in addressing client needs and concerns.

✔ Tools: Provide clients with tools and resources like workshops, webinars, and online courses to boost financial literacy.

✔ Competitive Pricing: Offer competitive rates & transparent pricing to attract and retain clients